I've spent most of my career working on Position and Risk Management Systems for banks, these systems are complex and highly configurable to handle trade lifecycles for various financial instruments, including derivatives. However, they're not well-suited for small & mid-sized enterprises (SMEs).

This forward rate calculator is included in this article to help businesses understand and calculate forward exchange rates.

The Challenge

SMEs handle a constant flow of payments in various currencies. Financial Managers must closely monitor cash balances and foreign exchange exposures. Maintaining sufficient liquidity while avoiding excess funds in non-interest-bearing accounts.

How would a finance manager answer the following questions?

- What are your projected foreign currency cash flows for the next 1, 3, and 6 months?

- How do these split between incoming and outgoing transactions? How many different currencies are involved in these cash flows?

- What portion of these cash flows remain unhedged or not locked into a fixed local currency rate?

- Do you have a dashboard that provides a clear view of your foreign exchange (FX) exposure?

- Is managing this FX exposure a priority for you? Or is it such a small percentage of your overall business that you haven't actively considered it?

Solutions to these questions range from spreadsheets to expensive systems like "Front Arena" or "Murex," which are often too costly and complex for SMEs to implement and maintain.

The Solution

The idea is to create a cloud-based FX Risk Management platform tailored to SMEs. It will support multiple currencies, with a focus on easy-to-use, out-of-the-box functionality to assist the company’s financial manager.

The platform should be user-friendly, cost-effective, and scalable for SMEs without dedicated development teams. Most importantly, the dashboard should offer impressive visuals with clear, actionable insights into cash balances and FX exposure.

If you have this problem, please let me know, I'd love to hear your thoughts and how you are solving it.

Typical Operational Setup

An example configuration that would need to be supported, where the company has 3 accounts and uses ZAR as PnL currency:

- Loan account in ZAR (South African Rand)

- The company needs to pay capital + interest on this loan monthly, in ZAR.

- Checking account in ZAR (South African Rand)

- Used to pay invoices from suppliers and salaries

- Receives money from South African customers here.

- Checking account in USD (US Dollar)

- Used to pay invoices from suppliers

- Receives money from US based customers here.

Interest rates earned for ZAR and USD are 8.65% and 2.6% respectively. These rates depends on the company and what accounts they qualify for.

A FIS Front Arena approach

How this FX Risk view can be modelled in Front Arena:

-

Create a PortfolioTree in Front Arena with the following structure:

- MegaFactory (Fictional company) - Compound Portfolio

- Operations - Physical Portfolio

- ZAR (Current account + known future Income and Expenses)

- USA (Current account + known future Income and Expenses)

- FX transactions - Physical Portfolio

- USD/ZAR

- Operations - Physical Portfolio

- MegaFactory (Fictional company) - Compound Portfolio

-

Model the current accounts:

Create Call Deposits for each currency in the Operations portfolio. Set up interest rates and cash balances accordingly.

In a real world scenario, you would use a service like SpikeData or Plaid, to integrate your banking transactions and balances directly into Front Arena. But for this example we will manually enter these.

-

Model the future income & expenses:

Create future-dated Cash Payments according to the due dates. This will allow us to discount the future cashflows easily, as well as bucket the cashflows by term (payment date).

In a real world scenario, you would integrate with your ERP system to get these cashflows imported.

To correctly discount your future casflows, make sure your yield curves are up-to-date for each of these currencies! (This is not covered in the scope of this example).

For this example, I've used stale yield curves with made up data. In a real-world scenario, you would have price feeds set up for your yield curve benchmark instruments.

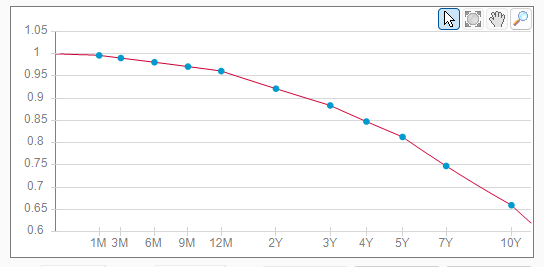

Discount curve used to calculate PV of future dated cash flows

Discount curve used to calculate PV of future dated cash flowsThis calibrated yield curve / derived discount curve is used for discounting the future dated cash flows.

When assessing future cash flows, are SMEs focused on present value analysis, or do they typically use the future values without discounting? -

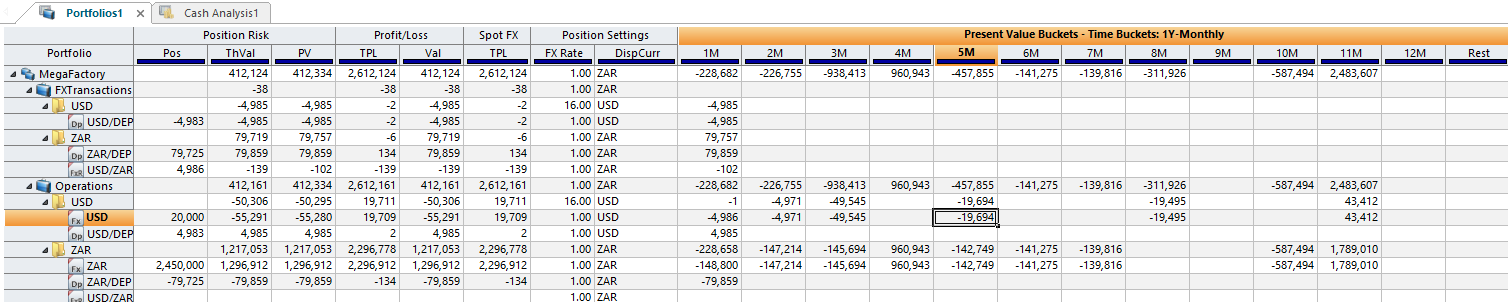

Use Trading Manager to view your projected cashflows and manage FX exposure by looking at the portfolio tree.

Insert a "Portfolio Sheet", with a Present Value (PV) vector column breaking down your exposure over certain time buckets.

The portfolio sheet will show the PV of the exposure in each currency, for each period.

Trading Manager view in Front Arena

Trading Manager view in Front ArenaYou can now see where your projected cash movement is negative (e.g. 5M bucket) and take action accordingly by creating future dated FX Cash Transactions.

-

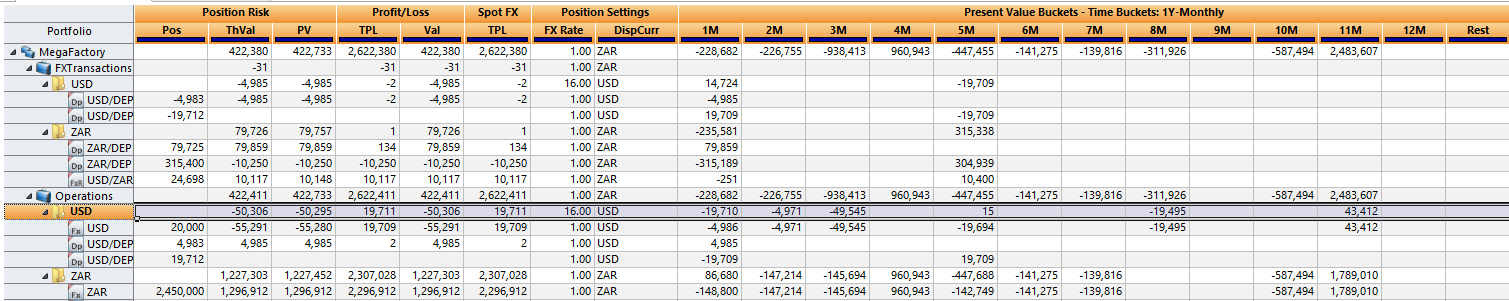

Create FX transactions to manage liquidity and exposure as needed.

There are various hedging strategies that can be applied to hedge against currency risk, we will only focus on deliverable FX Cash (as opposed to cash settled) to hedge against currency risk.

As an example from the previous screenshot, we want to hedge against the USD exposure in the 5M bucket. In practice we will use a "Foreign Exchange Contract" (FEC) to do this. Book a future dated FX Cash trade to buy USD and sell ZAR, this will lock-in the exchange rate for that transaction.

Trading Manager view after FX Cash

Trading Manager view after FX Cash

When a business is quoted a 1Y forward rate, do they know if this is fair or not? Do they only compare the quote against the spot rate? See this forward rate calculator below.

A Cloud-based FX Risk Management Platform

By designing a standalone system for this specific use case, we can fully control the user experience, making it as simple and intuitive as possible, including features like interactive charts. With a focused use case like this, user-side maintenance and configuration will be minimal, and data input integration will be more standardized.

While this system will have limited functionality compared to full-scale Position and Risk Management Systems like Front Arena, it compensates with its ease of use and low maintenance requirements.

An example of such a dashboard, showing projected account balance chart for a specific currency can be seen at the start of this article, showing inflows and outflows over time, as well as the current balance.

To help businesses understand and calculate forward exchange rates, I've included a Forward Rate calculator below.

Forward Exchange Rate Calculator

The forward exchange rate is calculated using this formula:

Where:

- = the current spot rate of the currency pair

- = the domestic currency interest rate

- = the foreign currency interest rate

- = time to maturity of the contract in days

- = days in year for domestic currency (day count convention)

- = days in year for foreign currency (day count convention)

I hope you found this useful! Please feel free to reach out if you want to discuss any ideas or opportunities for collaboration.

Keywords

#FX #Risk #Exposure #CashFlow #Dashboard #ForwardRate #Calculator