Pairs trading involves taking opposing positions in 2 markets, effectively taking a view on the difference between those markets.

Spread_AB = MarketPrice_B - MarketPrice_A

The chosen markets are not limited to crypto, traditional finance or sports betting markets, etc. You are only limited by your available/registered trading venues and execution tools.

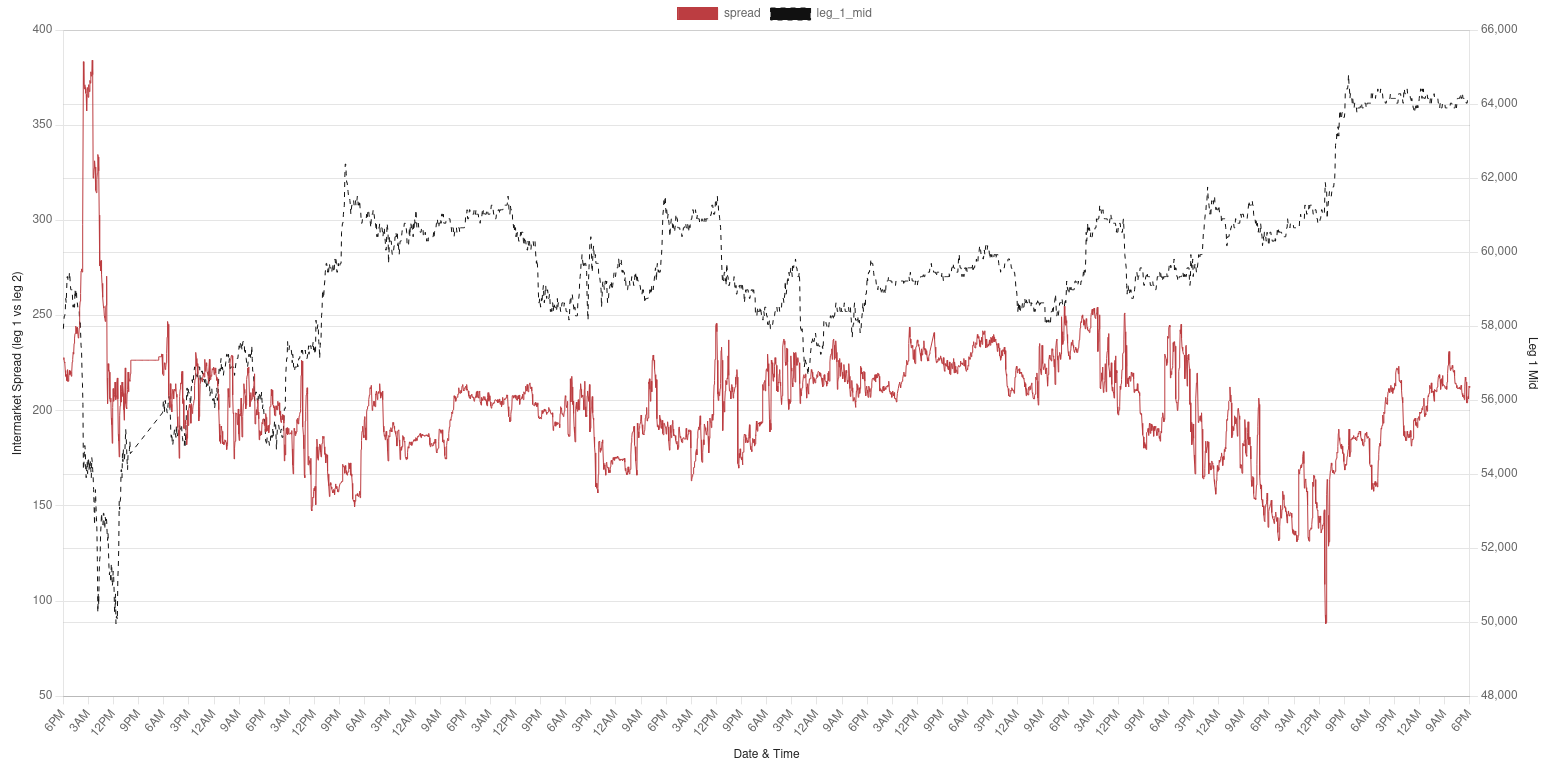

You can look at some tradable intermarket spread time series data here: SpreadAlgo.com

How to identify the pairs to trade?

- Find Correlated Assets: Look for pairs with a high historical correlation. This indicates that their prices move together and are likely candidates for pairs trading.

- Do a commonsense check: Do these markets have anything in common that explains the statistical relationship? e.g. are they in the same sector? E.g. CocaCola vs Pepsi

- Cointegration Tests - Are these markets suitable for pairs trading.

This is a Delta Neutral / Market Neutral strategy because it does not take a directional view on the markets, but rather a statistical view on the spread between them. It's also known as Spread Trading, although "Spread" is a heavily overloaded term in finance, Intermarket Spread is propably more accurate.

Basis trading is a type of pairs trading where the markets differ only by tenor or maturity, such as Spot vs. a 3-month future. This is a bit more complicated since there is a time to maturatiy component involved.

Why Pairs Trading?

Advantages

- Lower Risk: Offsetting positions reduces exposure to market-wide movements. Spread measure has lower volatility.

- Market Neutral: It is a market-neutral or delta-neutral strategy, meaning it does not depend on the overall market direction, but rather on the relative performance of two assets.

Disadvantages

- Analytical Skill Required: Selecting the right pair of markets requires experience, analysis, and intuition, as incorrect pair selection can lead to losses.

- Technical Skill Required: Depending on the execution speed needed, you will need to build infrastructure to execute trades and monitor exposures.

- Not a Get-Rich-Quick Strategy: Pairs trading is generally a slow and steady approach to trading, which will not appeal to everyone.

Common Pair Combinations:

- Same Asset on Different Exchanges: Trade the same asset, like BTC/USDT, across different exchanges (e.g., Binance vs. Kraken) to exploit price differences (arbitrage). Important to note that the underlying is fungible.

- Different Tenors: Trade the same asset with different maturities, such as BTC/USD spot vs. BTC/USD futures (basis trading). Beware of the credit risk to particular futures trading venue, and non-transferable nature of futures contracts.

- Same Sector Assets: Trade assets within the same sector, such as Coke vs. Pepsi or two correlated cryptocurrencies like ETH vs. SOL.

Order Execution styles:

Maker-Taker

-

Passively place your order on Leg_1 using a LIMIT order at the top of the orderbook, as soon as it fills, place a MARKET order on Leg_2. If you need help setting up execution infrastructure like this, reach out to me on LinkedIn or Telegram.

-

Advantages: Better spread fills, and lower trading fees. This execution strategy is implemented and available on TradeAlgos.net

-

Drawbacks: You are waiting for market activity on Leg 1, which might result in you losing the opportunity to enter the trade at the current spread level.

Taker-Maker

- Similar to above, but with Leg 2 being the passive leg.

Taker-Taker

-

Place market orders simultaneosly on both Leg_1 and Leg_2 of your trade.

-

Advantages: Achieves immediate fill.

-

Drawbacks: You cross the spread on both markets, reducing your "realised spread". You also pay Taker fees on both sides, making your trade more expensive.

A practical example:

If you'd like to see a practical example of this process, including profit/loss calculations, let me know on LinkedIn or Telegram.

Keywords

#Pairs #Spread #Trading #StatisticalArbitrage #ExecutionStrategy #MakerTaker